Real Estate-Value Creator®

„The whole is greater than the sum of its parts.”

Aristotle

This applies even more to complex cause and effect processes throughout the whole (special) assets.

With the Real Estate Value Creator® (RE-VC) you use a tool for analysis and simulation of all wealth-related management issues such as portfolio and asset management, property valuation, business planning, fund management, financial management and risk management related to real estate, the real estate portfolio as well as the whole (special) assets.

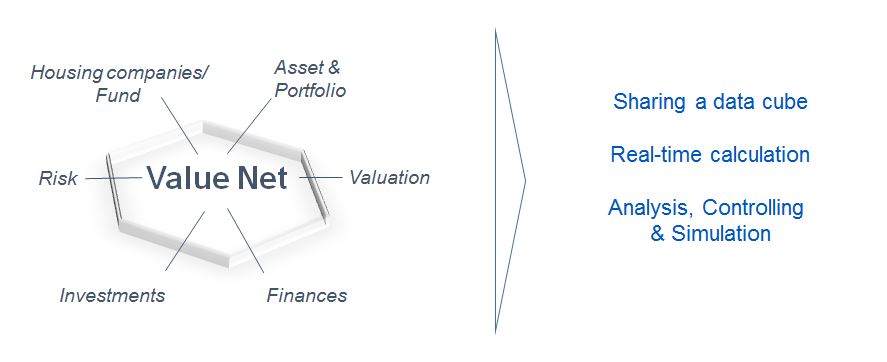

All assets are interwoven with regard to their cause and effect relationship in the Value Net. Changes on deep hierarchical levels (e.g. rent, operating expenses or market value) lead immediately to adaption of all the professional statements on higher asset levels (e.g. yield, equity values, statement of operations, statement of assets, income statement or balance). Any change in global assumptions (e.g. inflation, interest rates) acts consistently to the whole value network.

The value creation network of the RE-VC can be viewed from various expert perspectives. The drill-down on the polluters, multidimensional rotations as well as automatic and created by filter clusters of assets are always possible. Any number of scenarios can be created and compared with each other. Each scenario always includes all assets. With company's decision a plan version is fixed (target concept), which is constantly available for plan/actual comparisons as well as for plan/plan comparisons.

From a variatey of individual projects proven processes and computational algorithms were taken over into the configuration of RE-VC, Edition - Best Practice. In the meantime this standard is used by funds and listed companies, as well as housing associations and cooperatives and it offers an 3600 view around the asset.

IRM Knowledge Center

IRM Knowledge Center